What Does Best Investment Books Do?

Wiki Article

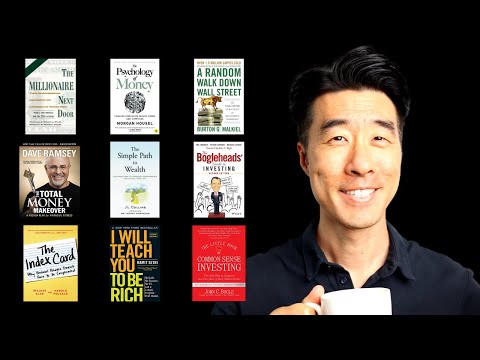

The very best Investment decision Publications

Considering turning into an improved Trader? There are various books which can help. Successful buyers read thoroughly to produce their competencies and stay abreast of emerging procedures for expense.

Things about Best Investment Books

Benjamin Graham's The Clever Trader is surely an indispensable manual for just about any Trader. It handles almost everything from essential investing approaches and hazard mitigation strategies, to benefit investing strategies and techniques.

Benjamin Graham's The Clever Trader is surely an indispensable manual for just about any Trader. It handles almost everything from essential investing approaches and hazard mitigation strategies, to benefit investing strategies and techniques.1. The Very little E book of Widespread Feeling Investing by Peter Lynch

Created in 1949, this vintage do the job advocates the worth of investing with a margin of basic safety and preferring undervalued stocks. Essential-browse for any person serious about investing, especially Individuals hunting further than index funds to identify particular higher-worth very long-time period investments. In addition, it addresses diversification ideas together with how to avoid staying mislead by current market fluctuations or other Trader traps.

This ebook supplies an in-depth guide on how to turn out to be An effective trader, outlining every one of the concepts each individual trader really should know. Topics reviewed inside the ebook vary from current market psychology and paper buying and selling methods, preventing prevalent pitfalls including overtrading or speculation and much more - building this book essential reading for critical traders who would like to make sure they have an in-depth expertise in fundamental buying and selling concepts.

Bogle wrote this extensive guide in 1999 to drop gentle about the hidden service fees that exist inside of mutual funds and why most traders would benefit a lot more from investing in lower-payment index funds. His guidance of saving for rainy day cash whilst not inserting all your eggs into a person basket together with purchasing inexpensive index funds continues to be legitimate nowadays as it had been back again then.

Robert Kiyosaki has long championed the significance of diversifying income streams by means of real-estate and dividend investments, especially property and dividends. Though Rich Dad Poor Dad may perhaps tumble far more into personal finance than particular advancement, Abundant Father Bad Father continues to be an enlightening study for anybody wishing to better recognize compound curiosity and the way to make their money perform for them rather then from them.

For one thing a lot more up to date, JL Collins' 2019 e book can offer some A great deal-needed standpoint. Intended to deal with the requirements of economic independence/retire early communities (Hearth), it focuses on achieving money independence by means of frugal residing, cheap index investing as well as four% rule - and ways to cut back scholar loans, invest in ESG property and take advantage of on the internet investment sources.

2. The Minimal E book of Inventory Marketplace Investing by Benjamin Graham

Considering investing but unsure how you can commence? This e-book offers sensible steering composed especially with youthful buyers in your mind, from considerable pupil mortgage credit card debt and aligning investments with personalized values, to ESG investing and on line monetary sources.

This greatest financial investment reserve demonstrates you how to recognize undervalued stocks and make a portfolio that can give a constant source of cash flow. Using an analogy from grocery procuring, this greatest reserve discusses why it is much more prudent to not center on high-priced, perfectly-marketed goods but as a substitute focus on reduced-priced, neglected ones at gross sales rates. Moreover, diversification, margin of security, and prioritizing worth about progress are all talked about thoroughly through.

A typical in its discipline, this ebook explores the basics of price investing and how to determine alternatives. Drawing upon his financial commitment corporation Gotham Money which averaged an once-a-year return of 40 % throughout twenty years. He emphasizes staying away from fads although paying for undervalued firms with solid earnings potential clients and disregarding brief-phrase current market fluctuations as crucial ideas of prosperous investing.

This best financial commitment reserve's author provides guidance For brand spanking new investors to steer clear of the problems most novices make and increase the return on their own cash. With move-by-move Guidance on creating a portfolio made to steadily expand after some time along with the creator highlighting why index resources deliver by far the most economical suggests of investment, it teaches readers how to take check here care of their program irrespective of marketplace fluctuations.

How Best Investment Books can Save You Time, Stress, and Money.

Whilst to start with printed in 1923, this guide continues to be an priceless tutorial for any person enthusiastic about taking care of their finances and investing correctly. It chronicles Jesse Livermore's ordeals - who gained and shed thousands and thousands above his life span - when highlighting the significance of likelihood concept as part of choice-producing procedures.

Whilst to start with printed in 1923, this guide continues to be an priceless tutorial for any person enthusiastic about taking care of their finances and investing correctly. It chronicles Jesse Livermore's ordeals - who gained and shed thousands and thousands above his life span - when highlighting the significance of likelihood concept as part of choice-producing procedures.If you're trying to find to enhance your investing expertise, you will find quite a few wonderful guides out there for you to decide on. But with restricted hours in daily website and constrained obtainable examining product, prioritizing only those insights which offer the most worth is often hard - And that's why the Blinkist application gives these kinds of easy accessibility. By accumulating key insights from nonfiction textbooks into bite-sized explainers.

3. The Very little E book of Value Investing by Robert Kiyosaki

4 Simple Techniques For Best Investment Books

This reserve addresses buying firms by having an economic moat - or competitive edge - which include an economic moat. The writer describes what an economic moat is and offers samples of several of the most renowned firms with one. Furthermore, this book information how to determine a corporation's value and buy shares according to price tag-earnings ratio - perfect for newbie buyers or everyone attempting to study the fundamentals of investing.

This reserve addresses buying firms by having an economic moat - or competitive edge - which include an economic moat. The writer describes what an economic moat is and offers samples of several of the most renowned firms with one. Furthermore, this book information how to determine a corporation's value and buy shares according to price tag-earnings ratio - perfect for newbie buyers or everyone attempting to study the fundamentals of investing.This doorstop expense guide is each well-known and complete. It covers most of the very best methods of investing, for example commencing younger, diversifying commonly and never having to pay substantial broker costs. Prepared in an attractive "kick up your butt" model which can either endear it to readers or transform you off wholly; when covering several typical items of recommendation (spend early when Other folks are greedy; be cautious when others come to be overexuberant), this text also endorses an indexing strategy which seriously emphasizes bonds when compared with numerous related approaches.

This guide offers an insightful approach for inventory buying. The creator describes how to select winning shares by classifying them into 6 unique classes - sluggish growers, stalwarts, rapidly growers, cyclical stocks, turnarounds and asset plays. By next this uncomplicated method you increase your odds of beating the market.

Peter Lynch is one of the globe's Leading fund supervisors, obtaining operate Fidelity's Magellan Fund for 13 several years with a mean return that defeat the S&P Index each get more info and every year. Revealed in 2000, his reserve highlights Lynch's philosophy for choosing stocks for personal investors within an obtainable way that stands in stark distinction to Wall Street's arrogant and overly technical approach.